Real Estate

Regarding the business of real estate, access to industry professionals and real estate assets, along with accessing proprietary asset-management performance platforms, Southpaw's residential-focused strategies create value through a combination of strategies.

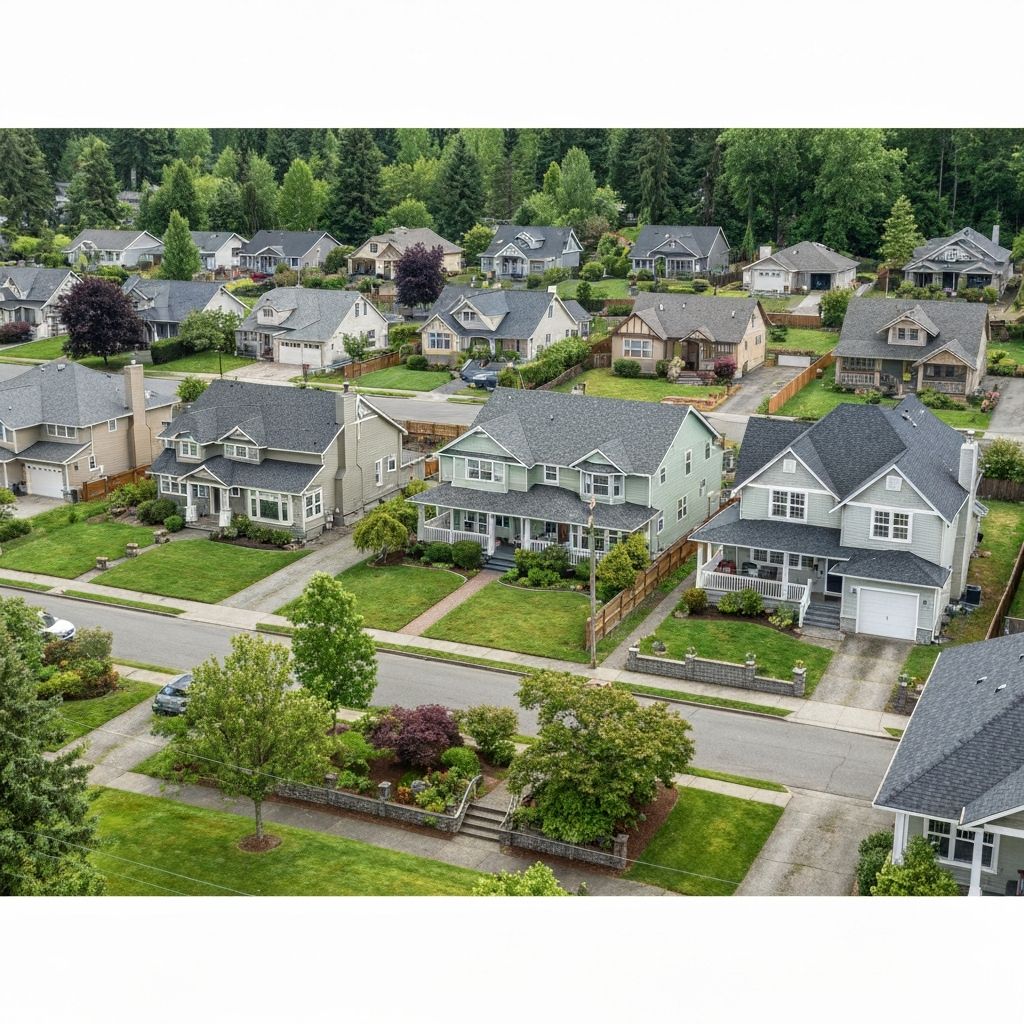

Single-Family Rental Homes

With an approximate market value of $36 trillion, the single-family home market in the United States has few peers. Single-family rentals account for an estimated 15 million units, with a market value of more than $5 trillion. And the vast majority of units are owned by non-institutional investors.

Southpaw relies on a group of experts to manage a variety of properties. Southpaw's superb team of savvy, seasoned professionals have a broad range of product knowledge — including liquid interest rate products, single-family rental properties, performing and non-performing whole loans, servicing, mortgage servicing rights, securitization and contract finance.

The company, and its vast network of affiliate partners, also have extensive experience with trading, structuring, securitization, modeling, banking and sales for major mortgage-backed securities issuers. Through proper analysis of loan and industry data, dual-track credit and prepayment modeling, and factoring in the identification of pricing inefficiencies, each investment opportunity undergoes a thorough screening process at Southpaw.